Anticipating When the Federal Reserve is Going to Cut Rates and by How Much

Garrick Werdmuller President and CEO of Fresh Home Loan Inc. explains what the odd makers are predicting for Rates in 2024

Unlocking Opportunities: Navigating Mortgage Rates in 2024

Projections and Insights: A Closer Look at Fed Rate Cuts

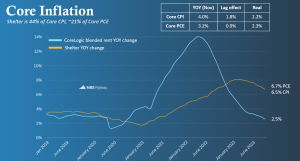

During the December meeting, the Fed projected a decline in the federal funds rate to 4.6%, down from the current target range of 5.25%-5.5%. According to reliable sources such as Barry Habib and MBS Highway, rate and market updates suggest that by March, and particularly by May, we could be approaching the coveted 2% inflation rate, setting the stage for the anticipated Fed rate cuts.

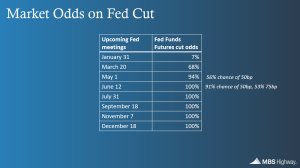

In January, odds makers indicated a 7% chance of a rate cut, with probabilities significantly rising by March 20th, making a rate cut seem almost certain by May. Some speculations even point to the possibility of three rate cuts by June 1st, indicating a potential trio of favorable adjustments by July.

The Feds Federal Reserve's Stance on Interest Rates as of January 2024

In the most recent Fed meeting, the Federal Reserve has maintained its interest rates for the fourth consecutive meeting, acknowledging the progress made in mitigating red-hot inflation. However, the central bank stopped short of indicating imminent rate cuts, citing the surprising strength of the economy.

The Federal Open Market Committee's (FOMC) decision suggests that the Fed is unlikely to raise its key benchmark borrowing rate beyond the current target range of 5.25-5.5 percent. While this level reflects a significant increase from 2023, it remains the highest since 2001, leading to substantial costs for consumers borrowing money. According to Bankrate data, mortgage rates, home equity lines of credit (HELOCs), and auto loans are at their highest levels in more than a decade.

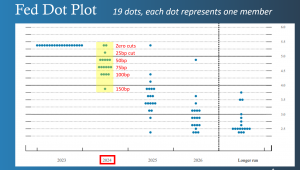

A closer look at the Fed Dot Plot, showcasing 19 dots representing Fed members, reveals a notable shift. While in 2023, all 19 members aimed for a Fed Funds rate of 5.5%, the plot for 2024, 2025, and 2026 suggests a prolonged period of low rates, signaling a more extended era of favorable rates in the coming years.

Implications for Homeowners and Prospective Buyers

Doug Duncan, Fannie Mae's Senior Vice President and Chief Economist, predicts a gradual recovery in home sales and mortgage origination activity in 2024. This positive outlook is fueled by the decline in inflation and the Fed's signaling of future rate cuts.

Duncan further anticipates mortgage rates to dip below 6% by the end of 2024, providing a boost to affordability. Homebuilders are expected to continue adding new supply, further aiding accessibility. The decline in mortgage rates is likely to drive refinancing volumes up, along with a potential uptick in purchase financing.

Navigating the Opportunities with Fresh Home Loan Inc.

AS the volatile mortgage market swings as it already has in 2024. Now more than ever is it is crucial to get your file, whether it be a purchase or a refinance, fully underwritten and approved.

As an Independent Mortgage Broker with over two decades of experience, Fresh Home Loan Inc. is well-positioned to assist clients in navigating through these tumultuous times. President and CEO, Garrick Werdmuller, along with his dedicated team, offers the experience, options, and wholesale rates necessary to guide clients through the evolving mortgage landscape.

Getting Purchase or Refinance Ready with Fresh Home Loan Inc.:

Amidst the uncertainty in the mortgage market, now more than ever is the time to ensure that one is well-prepared for a home purchase or refinance.

Whether a prospective homebuyer looking to capitalize on favorable rates or a current homeowner seeking to optimize mortgage terms through a refinance, Fresh Home Loan Inc. has the expertise to guide one through the process. The current landscape, marked by potential rate cuts and economic shifts, requires a seasoned partner to help you navigate and secure the best possible financing.

Why Choose Fresh Home Loan Inc.?

Experience: With over two decades in the industry, Garrick Werdmuller has weathered various market conditions, providing clients with valuable insights and reliable guidance.

Options: As an Independent Mortgage Broker, we offer a diverse range of mortgage options and wholesale rates, ensuring that you have choices tailored to your specific needs.

Personalized Service: The team at Fresh Home Loan Inc. understands that each client's situation is unique. We take the time to understand your goals and financial circumstances, crafting solutions that align with your objectives.

Proactive Approach: In a rapidly changing market, being proactive is key.

Connect with Fresh Home Loan Inc.:

Garrick Werdmuller

President CEO

Fresh Home Loan Inc

510.282.5456 (call/text)

NMLS 242952

www.FreshHomeLoan.com

Related Links:

Get a FREE Copy of my Book - The Cash Out Refinance Book

https://freshhomeloan.com/cashout/

Homebuyers, How to Win in a Challenging Housing Market

https://freshhomeloan.com/the-fresh-home-loan-home-buyers-concierge-program/

Accessory Dwelling Units in the Bay Area and How to Navigate Financing Options

https://freshhomeloan.com/unlocking-potential-the-rise-of-accessory-dwelling-units-in-the-bay-area-and-how-to-navigate-financing-options/

Disclaimer: All loan approvals are conditional and not guaranteed, subject to lender review of all information. Specified rates and products may not be available to all borrowers. Rates are subject to change according to market conditions. Fresh Home Loan Inc. is an Equal Opportunity Mortgage Broker in California, licensed by the California Department of Real Estate #02137513 NMLS # 2124104.

#MortgageRates #RealEstateNews #FedRates #HousingMarket #HomeBuyers #FinancialInsights #EconomicOutlook #InterestRates #Homeownership #PropertyInvestment #MarketTrends #FinanceTips #HomeAffordability #InvestmentOpportunity #HomeSale #alamedareatestae #bayarearealestate #freshhomeloan #garrickwerdmuller

ller

Garrick Werdmuller

Fresh Home Loan Inc

+1 510-282-5456

garrick@freshhomeloan.com

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Other

Market Watch 2024 with Garrick Werdmuller, President and CEO of Fresh Home Loan Inc

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.