TDG Gold Announces Acquisition of Anyox Copper and C$25 Million Bought Deal Private Placement

/EIN News/ -- NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

WHITE ROCK, British Columbia, June 17, 2025 (GLOBE NEWSWIRE) -- TDG Gold Corp (TSXV: TDG, OTCQX:TDGGF) (the “Company” or “TDG”) is pleased to announce that it has entered into an amalgamation agreement with Anyox Copper Ltd. (“Anyox”) which holds the former producing Anyox Copper project, located on the northwest coast of British Columbia, and a wholly-owned subsidiary of TDG (“Subco”), dated June 16, 2025 (the “Amalgamation Agreement”) pursuant to which the Company proposes to acquire all of the issued and outstanding securities of Anyox by way of a three-cornered amalgamation (the “Acquisition”) under the Business Corporations Act (British Columbia). In connection with the Acquisition, the Company is also pleased to announce that it has entered into an agreement with BMO Capital Markets (“BMO”), acting as lead manager and sole bookrunner, under which BMO, together with Clarus Securities (“Clarus”), acting as co-lead underwriter, and on behalf of a syndicate of underwriters (collectively, the “Underwriters”), has agreed to purchase, on a bought deal private placement basis, securities of the Company for aggregate gross proceeds of C$25 million (the “Concurrent Financing”, and together with the Acquisition, the “Transaction”).

Transaction Highlights (an online presentation is available here: link)

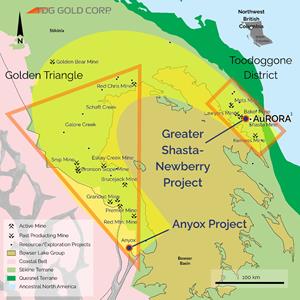

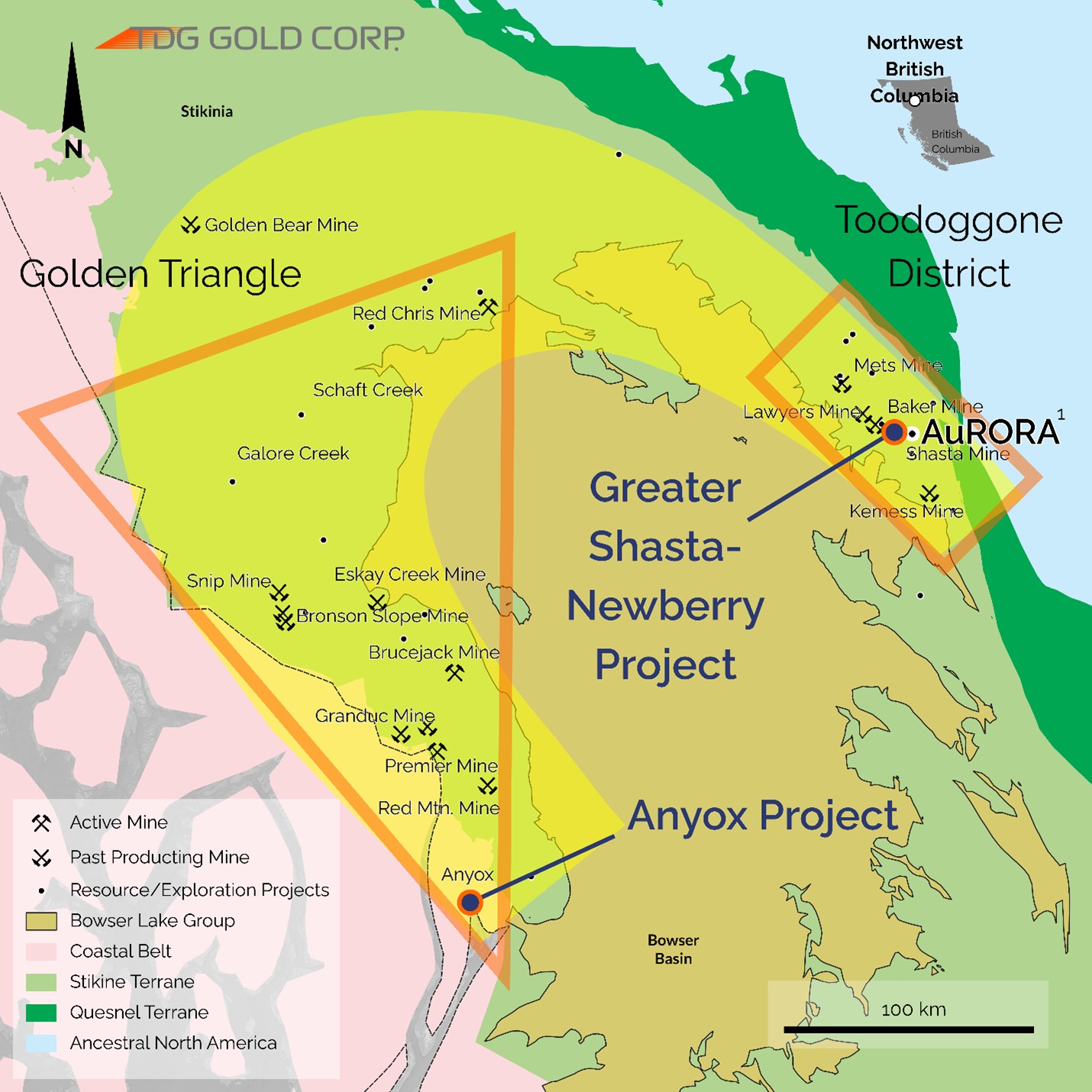

The combination of the privately held Anyox Copper project and TDG’s strategic tenure position in the evolving Toodoggone District provides shareholders exposure to precious metals and critical mineral targets in two established, past-producing mining districts within the ‘Golden Horseshoe’ of British Columbia (Figure 1). Assuming successful completion of the Transaction, TDG will have the ability to perform nearly year-round exploration activity, supported by a strong treasury, with cash greater than C$40 million, and a blue-chip shareholder registry that includes industry recognized institutional shareholders.

The arrangement also contemplates the appointment of Mr. Paul Geddes P.Geo as TDG’s Vice President Corporate Development. Mr. Geddes is currently the CEO of Anyox and Senior Vice President of Exploration & Resource Development for Skeena Gold + Silver (“Skeena”), a strategic investor in TDG.

Fletcher Morgan, TDG’s CEO, commented: “Our proposed acquisition of Anyox Copper marks an important milestone as TDG continues to evolve as a copper-gold exploration company and positions us as a leading tenure holder in the previously prolific Anyox mining district. We also welcome Paul Geddes to the TDG team. Paul’s expanded role for TDG will focus on ensuring operational excellence, as well as the continued growth of our platform as a regional consolidator. We are also pleased with the ongoing support from our strategic investor, Skeena, as they intend to invest $4M into TDG in connection with this Transaction.”

Paul Geddes, Anyox’s CEO, commented: “Combining Anyox and TDG provides potential for multiple, impactful discoveries in two mining districts in British Columbia. I look forward to combining the approach and expertise that has helped make Skeena a success with TDG’s technical experience and bringing that combination to both TDG’s Greater Shasta-Newberry project, located adjacent to the Freeport-Amarc AuRORA1 gold-rich copper porphyry discovery, and the Anyox project. Anyox offers rediscovery and new discovery potential, albeit at an earlier stage, though with a clear roadmap for advancement.”

Figure 1 – Map of North British Columbia: Toodoggone and Golden Triangle Districts.

Steven Kramar TDG’s Vice President Exploration, commented: “TDG's immediate priority remains Greater Shasta-Newberry – our exploration camp is now open, and the technical team is enroute to site to begin the 2025 exploration season. On closing, TDG’s expanded treasury would mean that we have the opportunity to resume gold-silver epithermal exploration at Shasta and Mets in parallel with our well-funded copper-gold porphyry exploration. Work at Anyox can take place at different times of the year, giving us an extended exploration season across two prime mining districts.”

TDG Board Changes

Effective June 16, 2025, Mr. Michael Kosowan, a current director and greater than 10% owner of TDG, has assumed the role of Chair of the Board of Directors, succeeding Mr. Stephen Quin. Mr. Quin will continue as a director of the Company and to lead TDG’s Technical Advisory Group. Incoming Chair, Michael Kosowan, commented: “We would like to thank Stephen for successfully guiding TDG through to this period of transformational change. My role is to build on the current momentum and continue to support the growth of the TDG platform to become a leading copper-gold exploration company in Canada.”

Proposed Share Consolidation

The TDG Board also wishes to provide notice to shareholders of its intention to seek shareholder approval at the Company’s next Annual General Meeting to consolidate the Company’s share capital on a five for one basis. This is part of TDG’s strategy to increase its appeal to Canadian, US and overseas investors.

Anyox Copper Project

Anyox represents a unique opportunity to expand TDG’s exploration portfolio. Located in the southern tip of British Columbia’s renowned ‘Golden Triangle’ (Figure 1), Anyox is host to the former underground high-grade Hidden Creek copper mine (1914-1935), and several undeveloped, near surface historical2 occurrences along a 12 kilometre (“km”) corridor that has tidewater access.

Given the scale of the district, the widespread distribution of surficial occurrences and the historical production, coupled with a paucity of recent exploration, Anyox represents an accessible district with both rediscovery and new discovery potential.

Anyox History

The Anyox Project hosts the Hidden Creek past producing mine that represents a subset of base and precious metal endowed volcanogenic massive sulphide (“VMS”) deposits known as the ‘Besshi Typea,b. The historical underground mine has a rich mining history: from its discovery in 1901, its subsequent development and operation, until it was decommissioned in 1935 due to the economic fallout of the Great Depression. Operations ceased due to prevailing metal prices rather than a lack of additional mineralization. Historical records2 indicate that, over its 21-year mine life (1914-1935), the mine produced ~750 million pounds (“Mlbs”) of copper to a maximum depth of ~300 metres and operators never deliberately recovered the associated potential precious and base metal by-products (zinc, lead, gold, silver, cobalt).

Terms of the Amalgamation Agreement

Under the terms of the Amalgamation Agreement, Anyox will amalgamate with Subco, and the Company will acquire all of the outstanding Class A common shares of Anyox (each, an “Anyox Share”) in exchange for common shares in the capital of the Company (the “Consideration Shares”) on a share exchange ratio that will result in upon completion of the Transaction, Anyox shareholders holding 20% of the outstanding common shares of the Company (the “TDG Shares”). The deemed price of each Consideration Share is $0.60.

The Amalgamation Agreement provides that the Acquisition is subject to several conditions including, among other things completion of the Concurrent Financing, a vote of the shareholders of Anyox, and receipt of all regulatory approvals, including TSX Venture Exchange (“Exchange”) approval.

Concurrent Financing

The Concurrent Financing will consist of the issuance of a combination of:

- 15,000,000 non-flow-through common shares of the Company (“NFT Shares”) at price of $0.60 per NFT Share;

- 11,700,000 non-critical minerals charity flow-through common shares of the Company (“Non-Critical CFT Shares”) at a price of $0.84 per Non-Critical CFT Share; and

- 6,700,000 critical minerals charity flow-through common shares of the Company (“Critical CFT Shares”, together with the NFT Shares and the Non-Critical CFT Shares, the “Financing Securities”) at a price of $0.93 per Critical CFT Shares.

Skeena intends to subscribe to 6,666,667 common shares of TDG at $0.60 for gross proceeds of $4,000,000, which will increase pro-forma ownership to 29,666,667 common shares, or 11 % of the Company.

The Financing Securities will be offered by way of private placement exemptions in all the provinces of Canada (except Quebec), the United States and other offshore jurisdictions as may be agreed between the Company and the Underwriters.

The Company has granted the Underwriters an option, exercisable at the applicable offering price up to 48 hours prior to the closing of the Concurrent Financing, to purchase additional Financing Securities representing up to 15% of the Financing Securities issued in connection with the Concurrent Financing. In consideration for the services rendered by the Underwriters in connection with the Concurrent Financing, the Company has agreed to pay to the Underwriters on closing a cash commission equal to 6% of the gross proceeds from the Concurrent Financing.

The Company plans to use the proceeds of the Concurrent Financing as follows:

- an amount equal to the gross proceeds from the sale of the Non-Critical CFT Shares will be used by the Company to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as such terms are defined under the Income Tax Act (Canada) (the “Tax Act”) related to the Company’s mineral properties in British Columbia;

- an amount equal to the gross proceeds from the sale of the Critical CFT Shares will be used by the Company to incur “Canadian critical minerals exploration expenses” that qualify as “critical mineral flow-through mining expenditures” as such terms are defined under the Tax Act related to the Company’s mineral properties in British Columbia; and

- the net proceeds from the sale of the NFT Shares will be used by the Company for: (i) continued exploration on TDG’s mineral properties in British Columbia, with a principal focus on the Greater Shasta-Newberry project and Baker Complex, (ii) exploration of the Anyox Property, (iii) costs of completing the Acquisition, and (iv) general working capital.

- The current intended exploration expenditure allocation among the projects from the Concurrent Financing will be:

- ~C$8 million in 2025 on Greater Shasta-Newberry and the ~12 km structural corridor surrounding to include geophysics, geochemistry and detailed geological mapping plus diamond drilling initially at the AuWEST target on the boundary with AuRORA1; with follow-up activities also planned at TDG’s epithermal gold-silver projects.

- ~C$5 million on the Anyox project before the end of 2025 including geophysics to help define initial drill targets for drill testing; and leading to a proposed second phase of drilling for an additional ~C$5 million in 2026.

The Consideration Shares and Financing Securities issued in connection with the Concurrent Financing will be subject to a four-month and one day hold period from the date of issuance thereof. The Acquisition and the Concurrent Financing are expected to close concurrently, and are cross-conditional upon one-another. The Transaction remains subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the approval of the Exchange.

Caution to US Investors

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About TDG Gold Corp.

TDG is a major mineral tenure holder in the Toodoggone District of north-central British Columbia, Canada, with 100% ownership of ~50,000 hectares of brownfield and greenfield exploration ground.

In 2023, TDG defined the 5.5 sq.km Greater Shasta-Newberry exploration target area (news release Jan 25, 2023) which is located directly adjacent to the gold-rich copper porphyry AuRORA1 discovery announced by Freeport McMoran Inc. and Amarc Resources Ltd. (news release Jan 17, 2025).

In 2024, TDG identified new copper-gold target areas over an expanded footprint covering ~53 sq.km known as the ‘Baker Complex’ (news release Feb 28, 2024), including the North Quartz (news release Apr 02, 2024) and Trident (news release Mar 07, 2024) targets. In January 2025, TDG identified an additional porphyry copper +/- molybdenum target at Erebus located within TDG’s Bot project (news release Jan 17, 2025). In February 2025, TDG completed the Sofia acquisition, which includes porphyry copper +/- molybdenum +/- gold targets (ARIS Report 41231).

TDG’s other projects within the property package include the former producing, gold-silver Shasta and gold-silver-copper Baker mines, which produced intermittently between 1981-2012, and the historical high-grade gold Mets developed prospect, all of which are road accessible, and combined have over 65,000 m of historical drilling. These projects have been advanced through compilation of historical data, new geological mapping, geochemical and geophysical surveys and, at Shasta, 13,250 m of modern HQ drill testing of the known mineralization occurrences and their potential extensions. In 2025, TDG published an updated Mineral Resource Estimate4 for Shasta (news release Jan 08, 2025), which remains open at depth and along strike.

Qualified Person

The technical content of this news release regarding TDG’s properties has been reviewed and approved Steven Kramar, MSc., P.Geo., Vice President, Exploration for TDG Gold Corp., a qualified person as defined by National Instrument 43-101.

The technical content of this news release regarding Anyox’s properties has also been reviewed and approved by Paul Geddes, BSc., P.Geo, Chief Executive Officer of Anyox Copper Ltd., a qualified person as defined by National Instrument 43-101.

Notes

1Adjacent Properties: The Company has no interest in, or rights to, any of the adjacent properties mentioned, and exploration results on adjacent properties are not necessarily indicative of mineralization on the Company’s properties. Any references to exploration results on adjacent properties are provided for information only and do not imply any certainty of achieving similar results on the Company’s properties.

2Historical Data: This news release includes historical information that has been reviewed by TDG’s and/or Anyox’s qualified person (QP). TDG’s and/or Anyox’s review of the historical records and information reasonably substantiate the validity of the information presented in this presentation. TDG encourages readers to exercise appropriate caution when evaluating these data and/or results.

3Third-Party Mineral Projects: These deposits are cited solely for geological context. The Company cautions that these properties are not adjacent to, nor does the Company have any interest in or control over them. Although certain geological features may be similar, there is no assurance that mineralization comparable to these deposits will be discovered on the Company’s property. The potential quantity and grade, if any, on the Company’s property are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether further exploration will result in the delineation of a mineral resource. Information regarding the aforementioned deposits is taken from publicly available sources and technical reports believed to be reliable, but has not been independently verified by the Company(s).

4Mineral Resource Estimate (MRE): All scientific and technical information relating to the TDG’s Shasta Project pertaining to the Shasta Mineral Resource Estimate (“Shasta MRE”) contained in this news release is derived from the Technical Report dated February 21, 2025 (with an effective date of December 29, 2024) titled “2025 Updated Resource Estimate For The Shasta Deposit” (the “2025 Technical Report”) prepared by Sue Bird, MSc., P.Eng. of Moose Mountain Technical Services. The information contained herein in respect of the Shasta MRE is subject to all of the assumptions, qualifications and procedures set out in the 2025 Technical Report and reference should be made to the full text of the 2025 Technical Report, a copy of which has been filed with the securities regulators in each of the provinces of Canada (except Québec) and is available on www.sedar.com.

aNiino, T., (1978). Geology and ore deposits of the Besshi district, Japan. In: Kuroko and Related Volcanogenic Massive Sulfide Deposits, Economic Geology Publishing Company, Memoir 31, pp. 343–354

bFranklin, J.M., Gibson, H.L., Galley, A.G., and Jonasson, I.R. (2005). Volcanogenic massive sulfide deposits. In: Hedenquist, J.W., Thompson, J.F.H., Goldfarb, R.J., Richards, J.P. (Eds.), Economic Geology 100th Anniversary Volume, pp. 523–560.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to the completion of the Acquisition or the Concurrent Financing, the planned use of proceeds of the Concurrent Financing, and timely receipt of all necessary approvals, including any requisite approval of the Exchange, and exploration plans of the Company.

As well, Forward-looking Information may relate to: future outlook and anticipated events, such as the consummation and timing of the Arrangement can Concurrent Financing; the strategic vision for TDG following the closing of the Arrangement and expectations regarding exploration potential, and future financial or operating performance of TDG post-closing, including share price performance; 2025 cost guidance; the potential valuation of TDG following the closing of the Arrangement; the accuracy of the pro forma financial position and outlook of TDG following the closing of the Arrangement; the success of the new management team; the satisfaction of the conditions precedent to the Arrangement; the success of TDG and Anyox in combining operations upon closing of the Transaction; the potential of TDG to meet industry targets, public profile and expectations; and future plans, projections, objectives, estimates and forecasts and the timing related thereto.

Statements contained in this release that are not historical facts, including all statements regarding the planned completion of the Acquisition and the Concurrent Financing, are forward-looking statements that involve various risks and uncertainty affecting the business of the Company. Such statements can generally, but not always, be identified by words such as "adjacent", "plans", "prolific", "focus", "extension", “intended”, "advance", "potential", “opportunity,” “impact”, “establish”, “propose”, “strategic”, “important”, “plan”, “milestone”, “prime”, “success”, “undertake”, “provide”, “preeminent”, “contemplate”, “exposure”, “strong”, “transformation”, “represent”, “numerous”, “accessible”, “intension”, “ability”, “intend”, “identify”, “expand”, variants of these words and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. All statements that describe the Company's plans relating to operations and potential strategic opportunities are forward-looking statements under applicable securities laws. These statements address future events and conditions and are reliant on assumptions made by the Company's management, and so involve inherent risks and uncertainties, including, the inability to satisfy the conditions precedent to complete the Acquisition, including a positive vote of the Anyox shareholders; the inability to complete the Concurrent Financing; the ability or inability to obtain all necessary regulatory approvals for the Acquisition and the Concurrent Financing; consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; fluctuations in exchange rates; the business objectives of the Company; the interpretation that the Greater Shasta-Newberry Target Area represents a larger mineralized system encompassing several target zones and the potential that such zones may represent additional Shasta-like deposits; whether economic mineralization can be defined and, if it can be permitted for development; the uncertainty that any mineralization encountered on adjacent properties continues on to TDG tenure; the uncertainty that geological and/or geophysical and/or any trends, interpretations, or conclusions related to adjacent properties have relevance to TDG and/or Anyox tenure; whether the mineralization at the Hidden Creek mine can be increased and, if so, whether it is economic and can be permitted for development; whether the other surficial mineralized zones on Anyox’s tenure are indicative of larger mineralized systems and, if so, whether an economic mineral resource can be defined and permitted for development; the uncertainty that the exploration season can be extended; changes in project parameters as plans to continue to be refined; the consequences and implications of the historical mining activities on the environment and whether such affects the potential exploration and/or development of any mining operation at Anyox; the implications of First Nation’s claims and land claims settlements on TDG’s projects; accidents, labour disputes and other risks of the mining industry and such further risks as disclosed in the Company's periodic filings with Canadian securities regulators. As a result of these risks and uncertainties, and the assumptions underlying the forward-looking information, actual results could materially differ from those currently projected, and there is no representation by the Company that the actual results realized in the future will be the same in whole or in part as those presented herein. Readers are referred to the additional information regarding the Company's business contained in the Company's reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on the Company and the risks and challenges of its business, investors should review the Company's filings that are available at www.sedarplus.ca.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company does not undertake to update any forward-looking statements, other than as required by law.

Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding mineral properties included in this news release, was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. Accordingly, information contained in this news release is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/84c8b61a-b503-47f3-8cc6-33c2feb3515d

Distribution channels: Banking, Finance & Investment Industry, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release